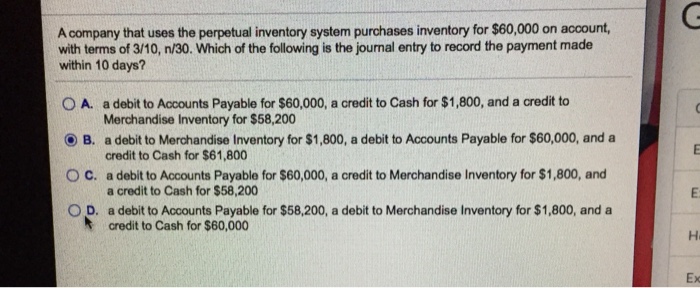

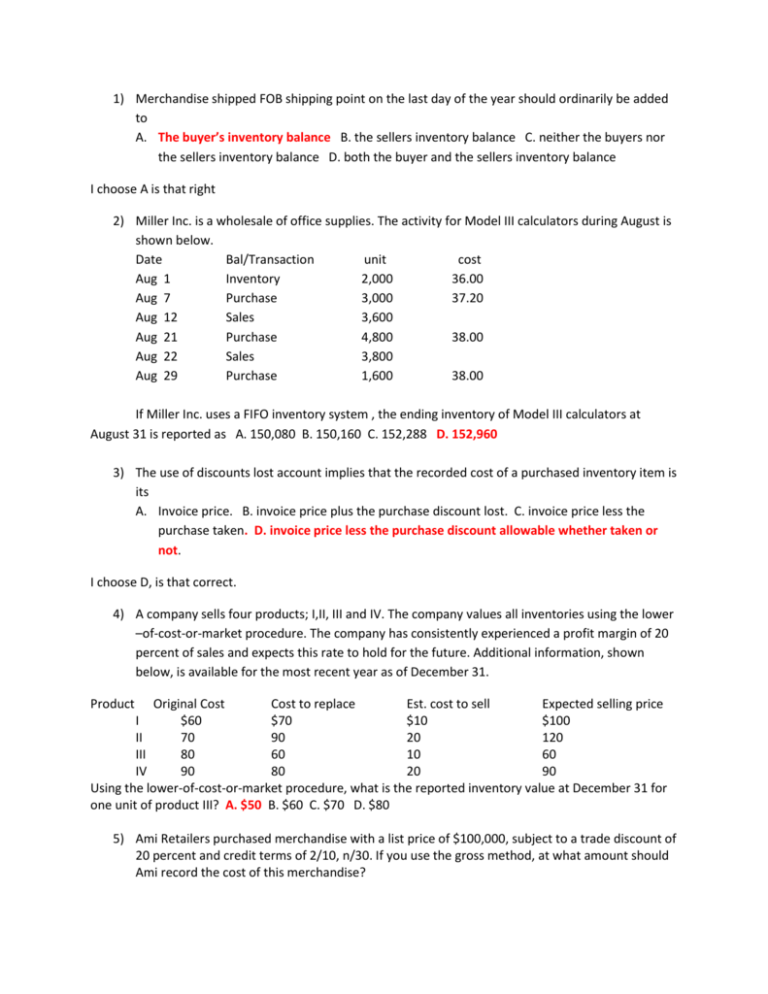

A Company That Uses The Perpetual Inventory System Purchased Inventory For

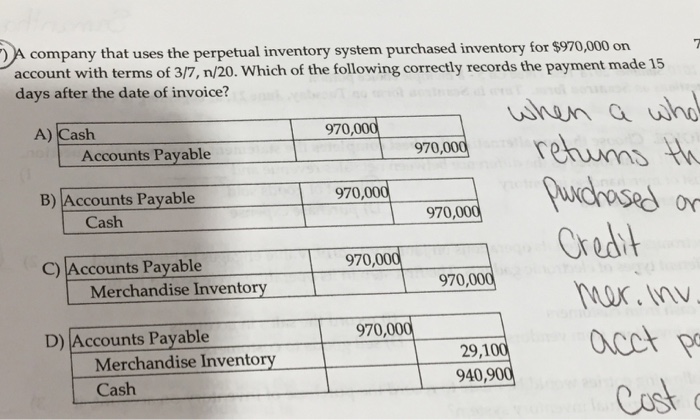

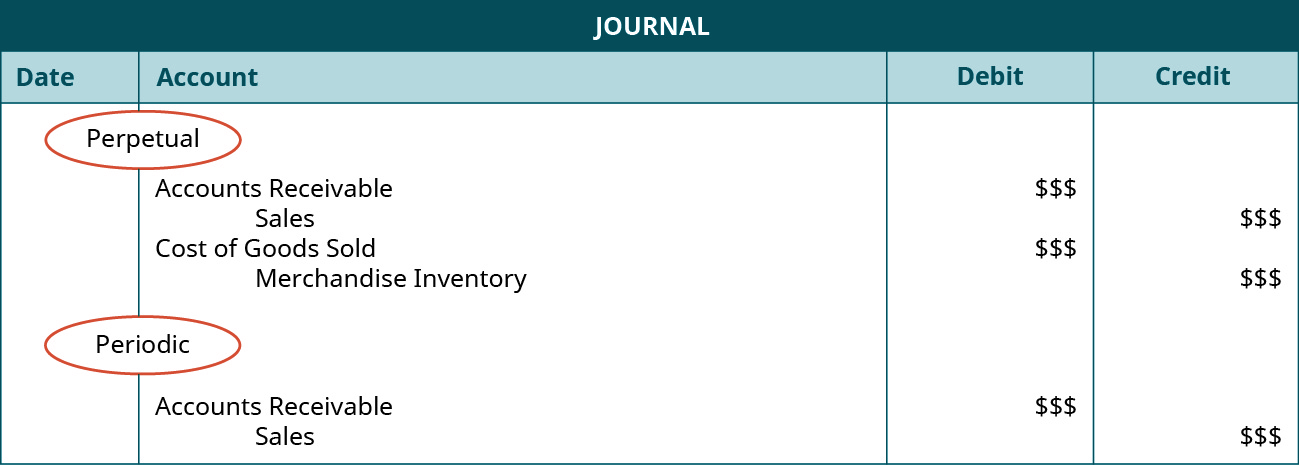

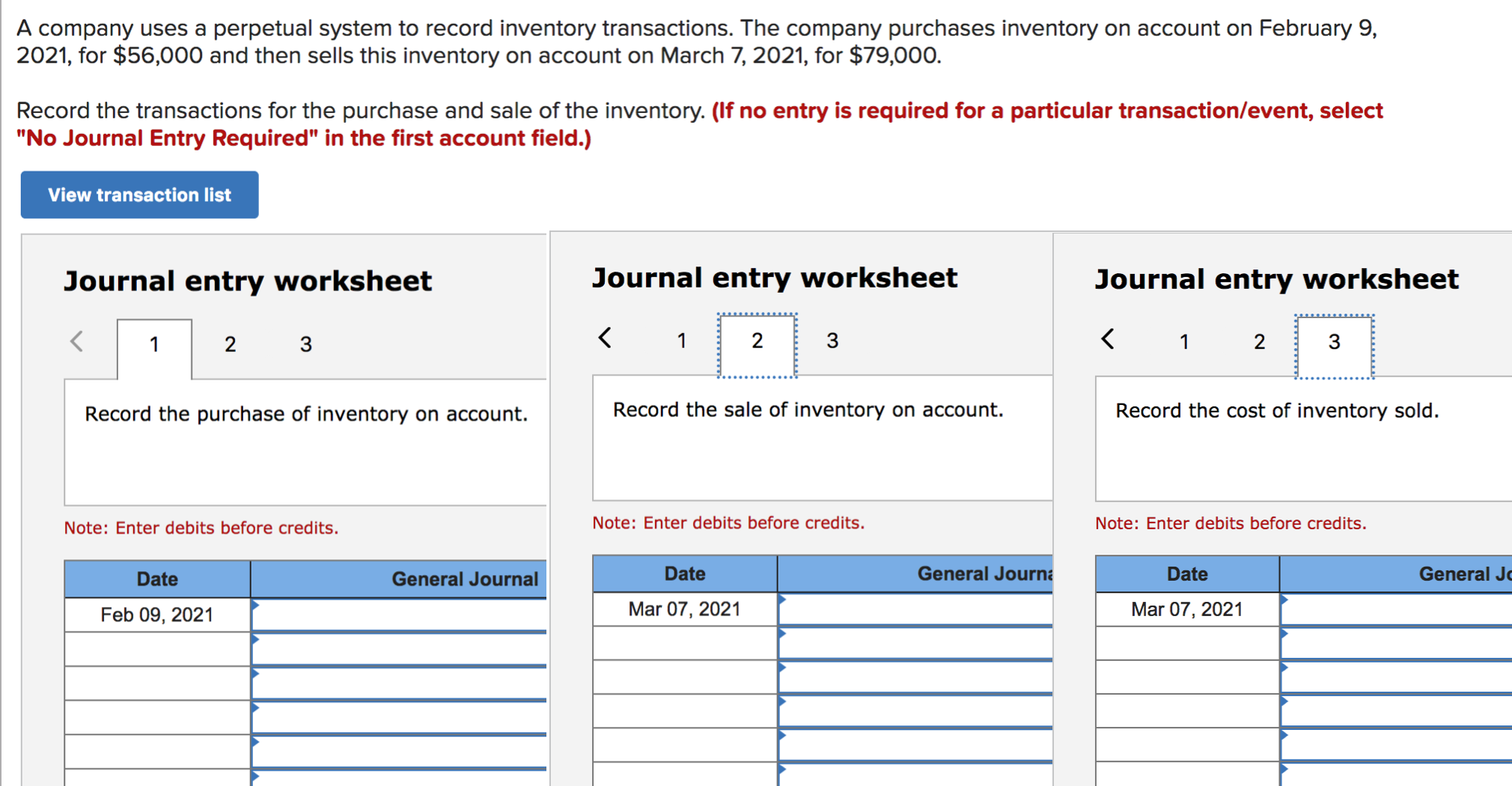

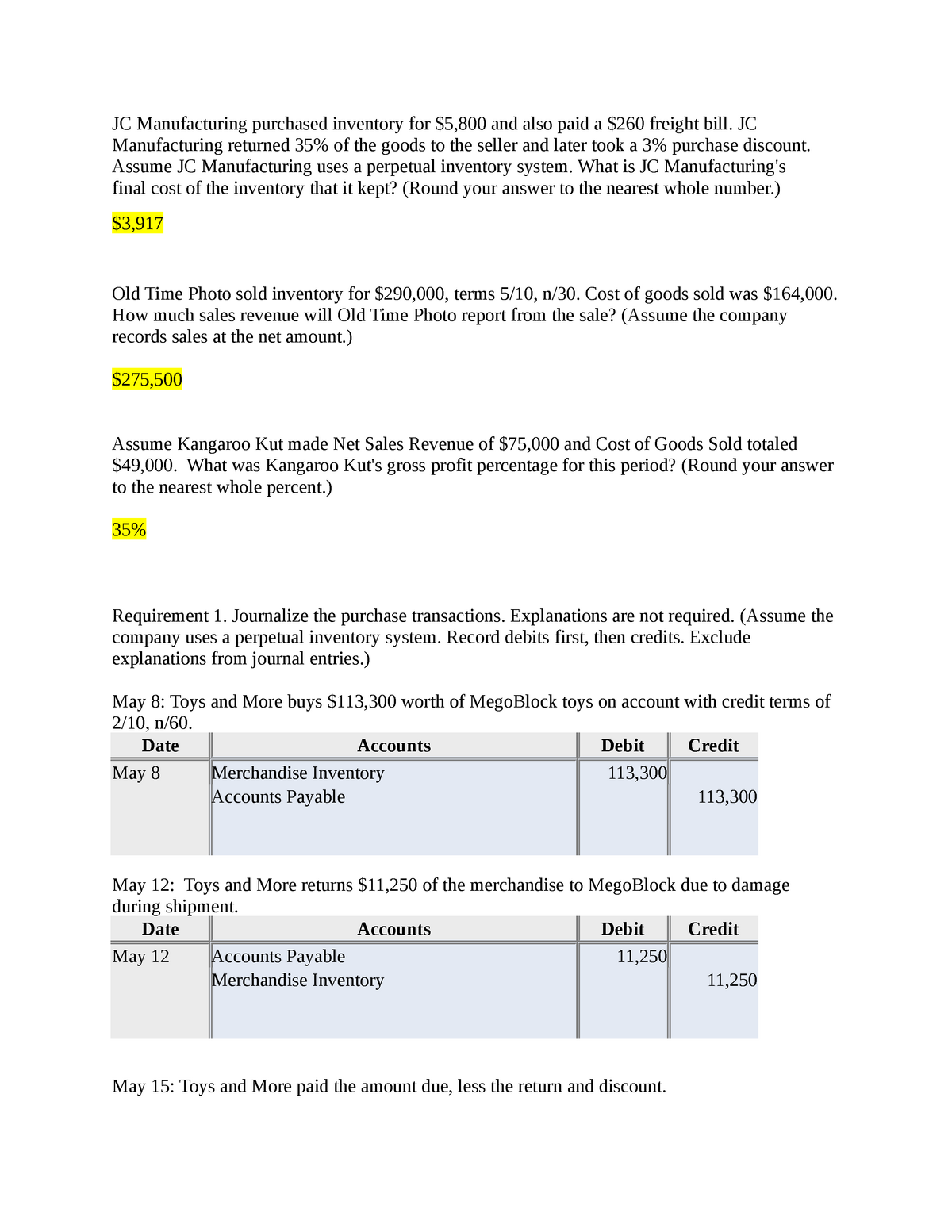

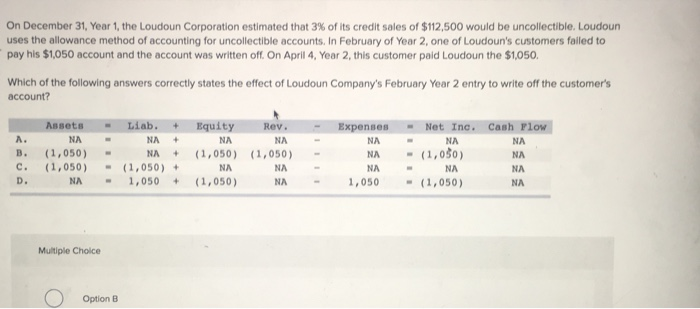

A company that uses the perpetual inventory system purchased inventory for. Journal entries in a perpetual inventory system. A perpetual inventory system keeps continual tracking of inventories and COGS. This transaction increases the companys assets specifically cash by 15000 and increases owners equity by 15000.

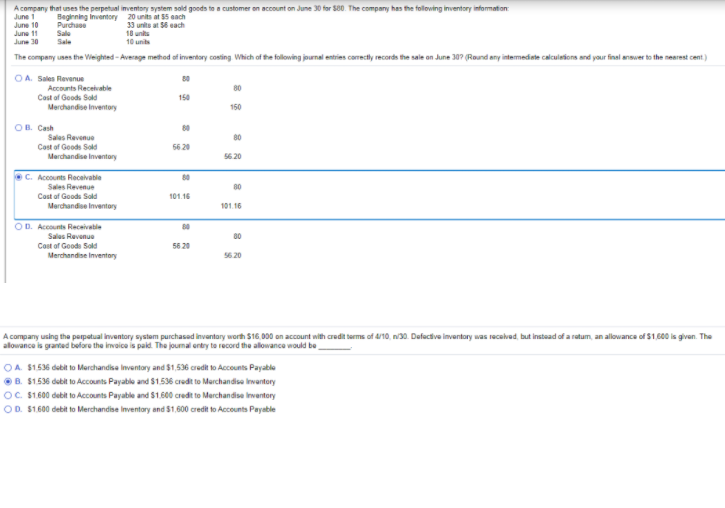

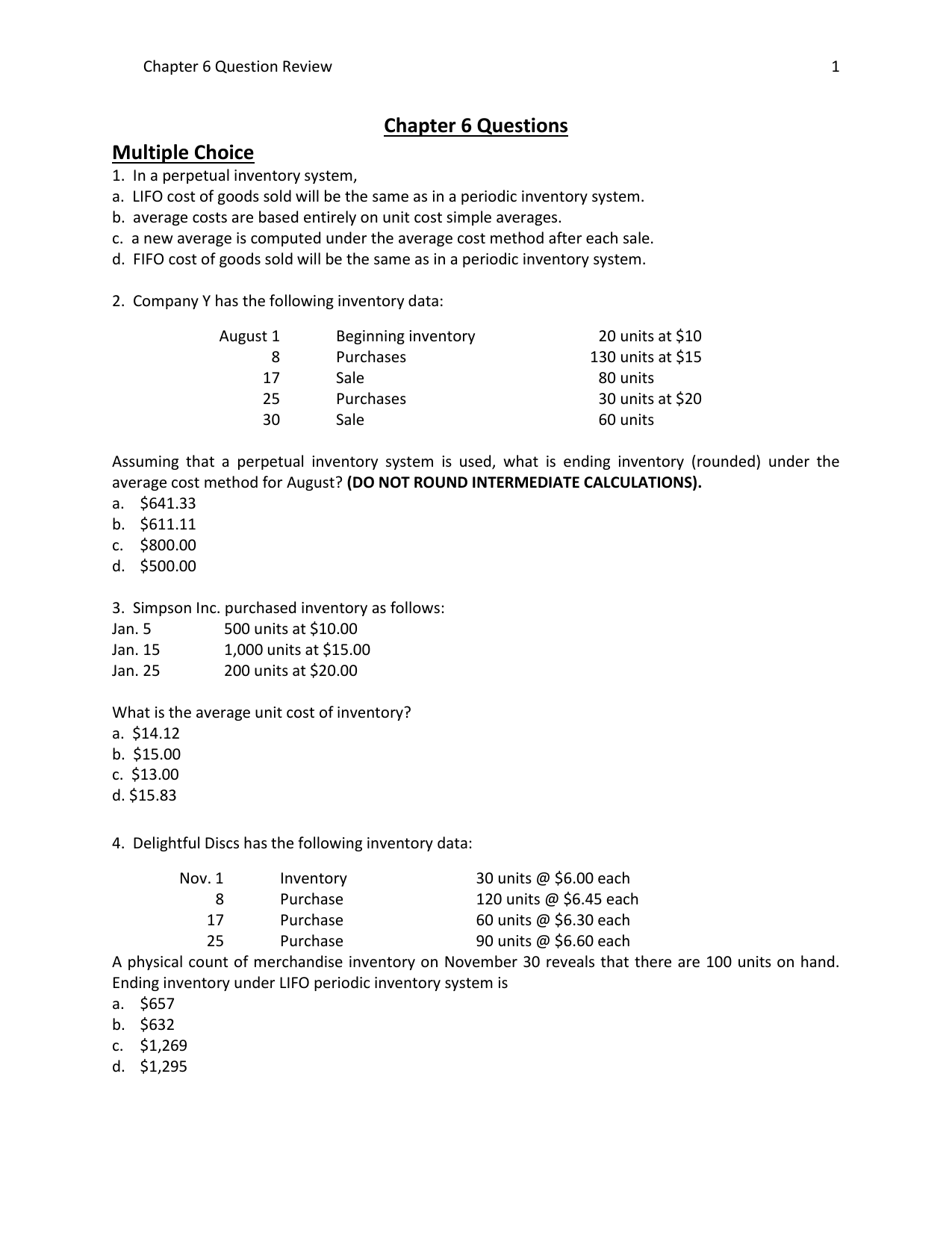

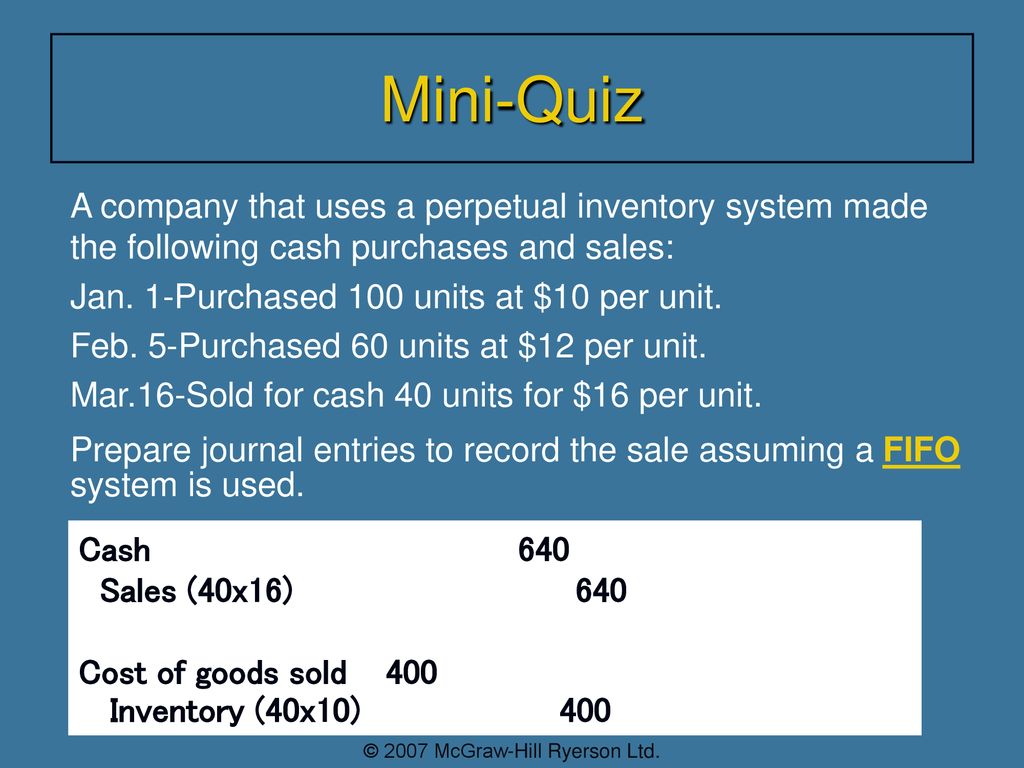

Check all that apply. This method uses the inventory that was purchased first when calculating what was sold in a given period. First in first out.

Experts think perpetual inventory systems are the future especially for product companies as they are getting cheaper and more accessible for even small businesses to acquire and use. This method uses the inventory that was purchased most recently when calculating what was sold in a given period. Traditionally the perpetual inventory system was used by companies that buy and sell easily identifiable inventories such as jewelry clothing and appliances etc.

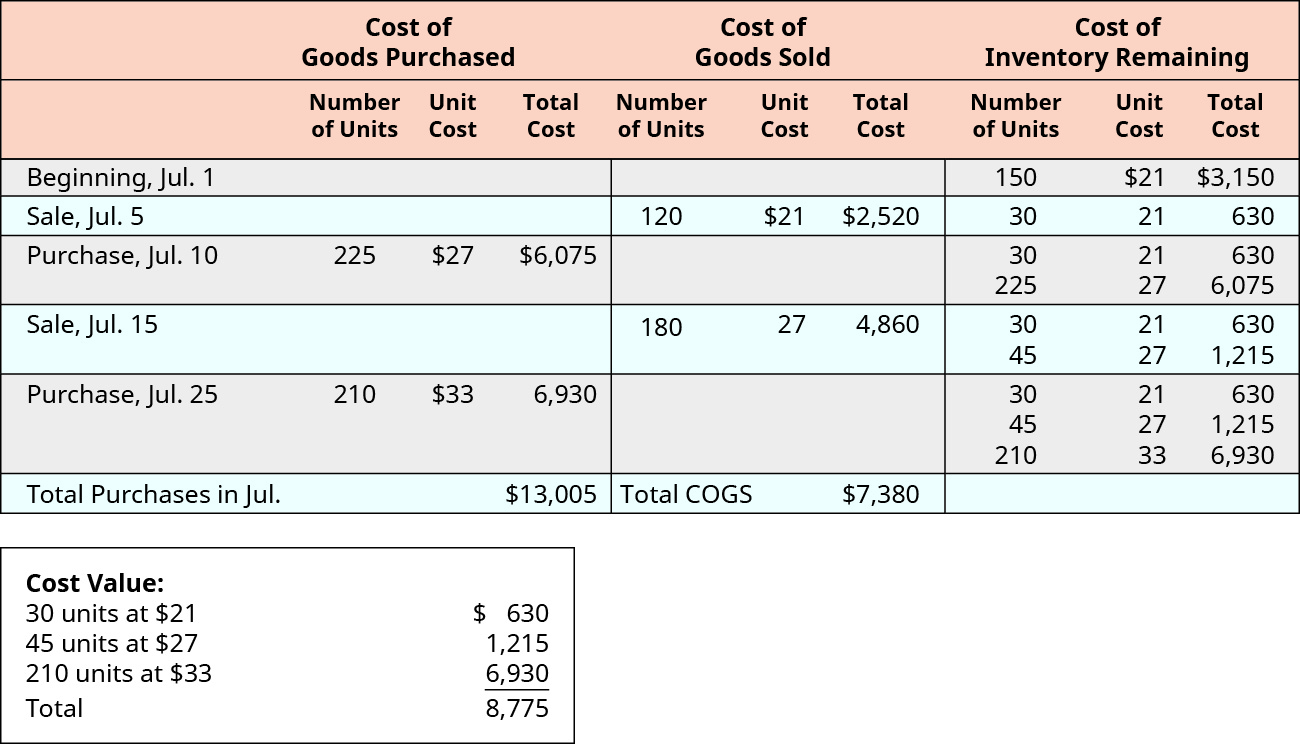

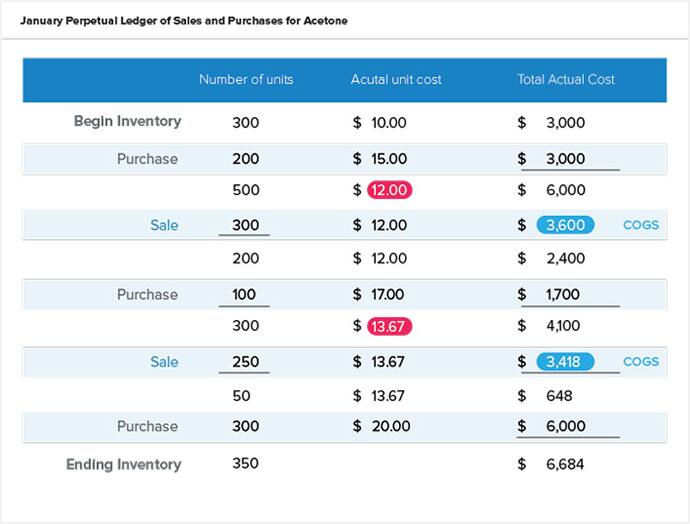

Assume that we use a perpetual inventory system and that five identical units are purchased at the following four dates and costs. The net result of using weighted average costing is that the recorded amount of inventory on hand represents a value somewhere between the oldest and newest units purchased into stock. In perpetual system if buyer A purchased 100 for inventory B from vendor C for the first month and sold all to customer D.

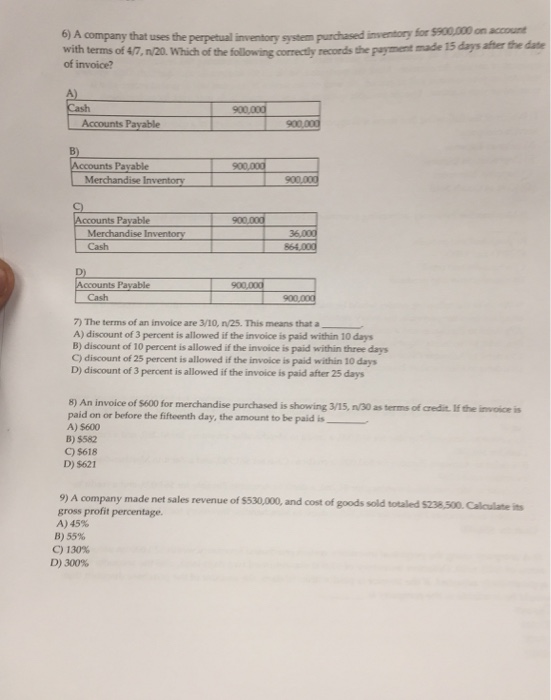

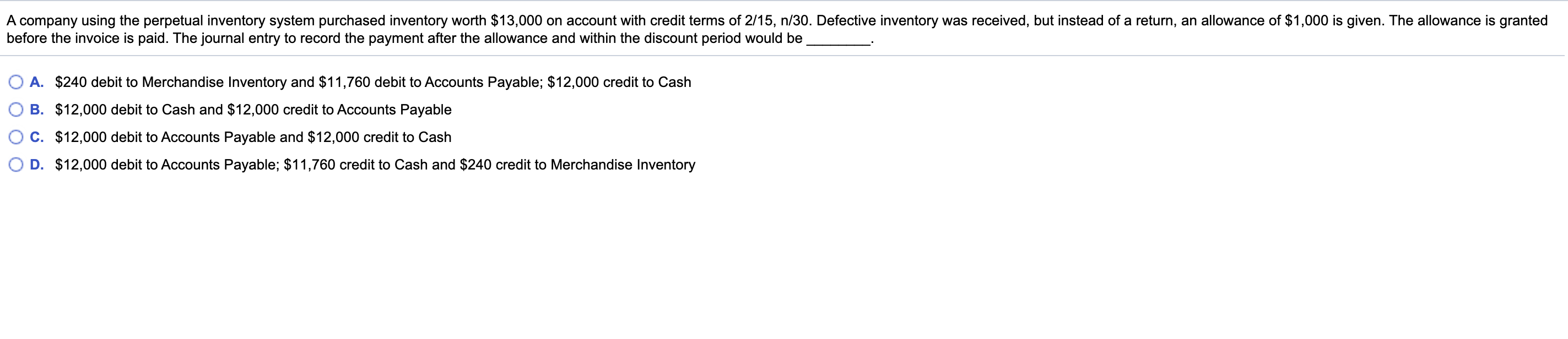

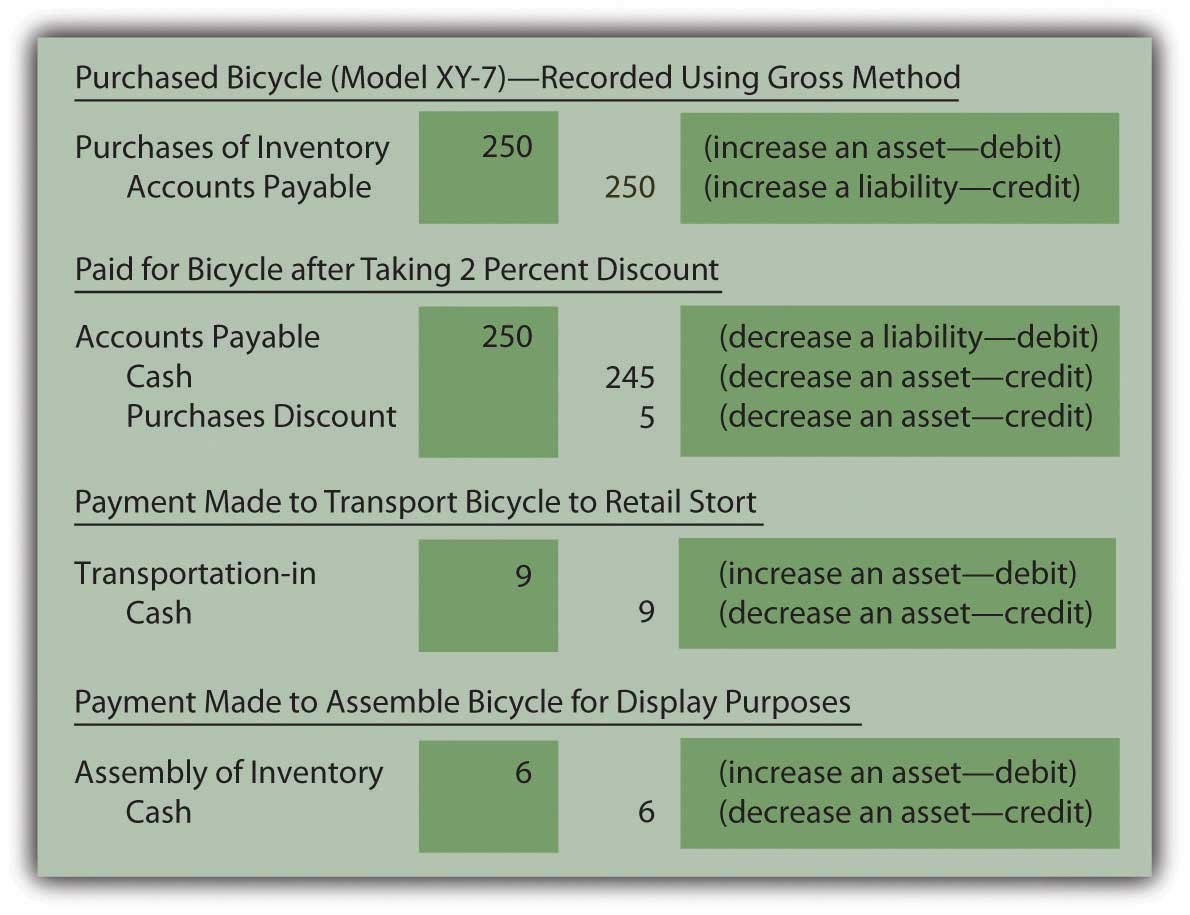

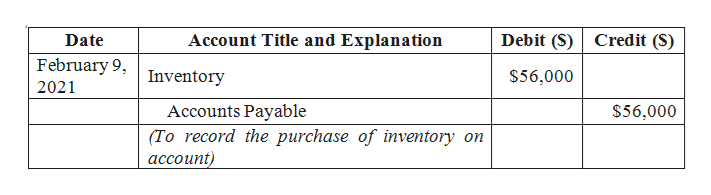

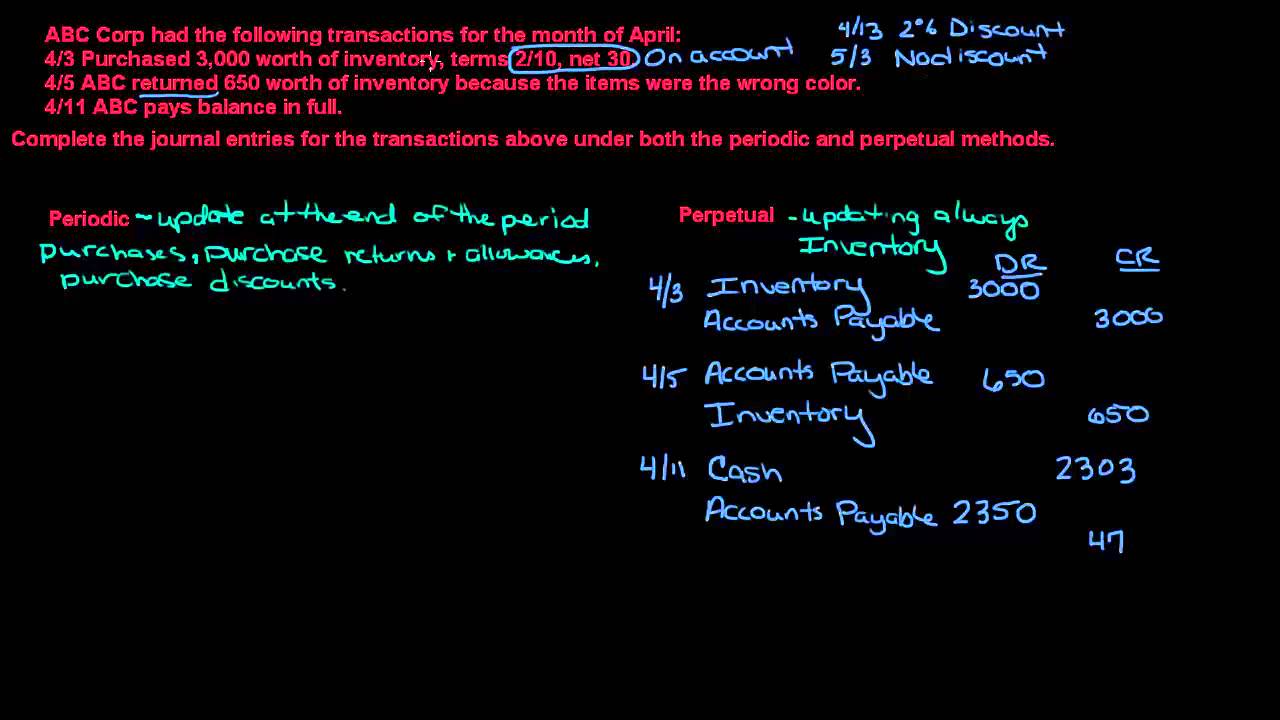

Credit terms were 210 n30. The ending inventory B for the month is 0. Get this - US.

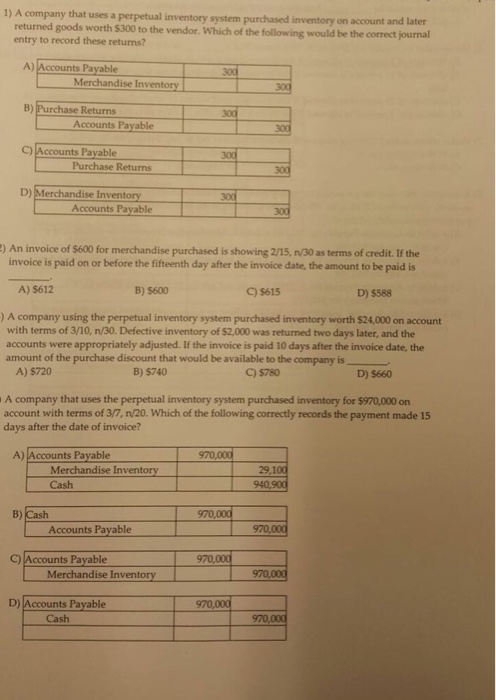

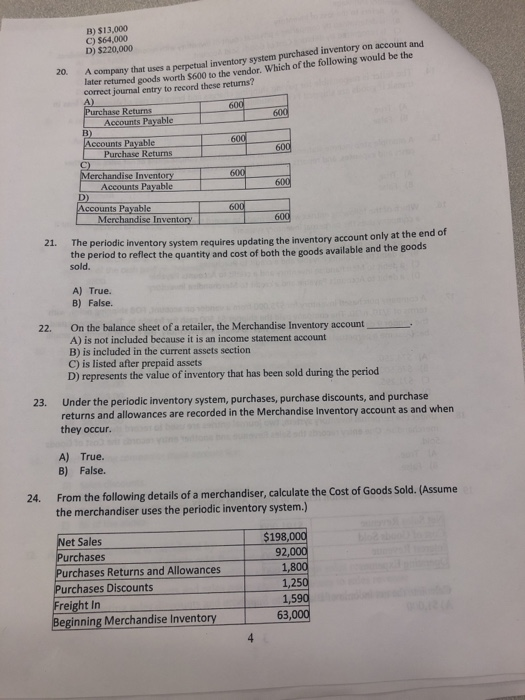

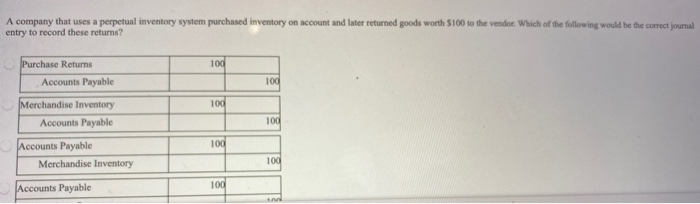

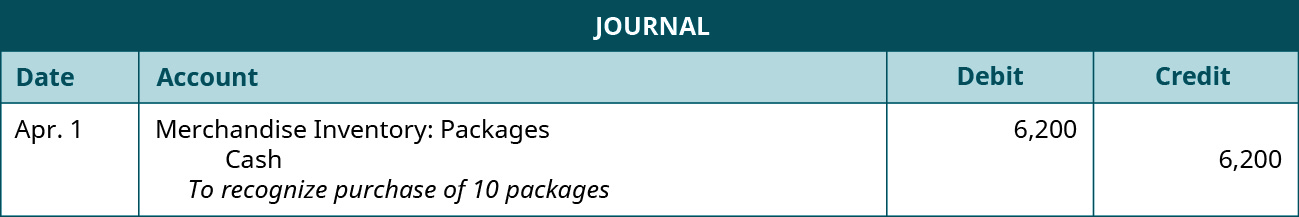

LOL Music Store uses the perpetual inventory system to account for its merchandise. A company using a perpetual inventory system that returns goods previously purchased on credit would debit Accounts Payable and credit Inventor If a purchaser using a perpetual inventory system pays the transportation costs then the. The Sunshine company uses a periodic inventory system.

A short summary of this paper. Notice that the accounting equation remains in balance.

This method uses the inventory that was purchased first when calculating what was sold in a given period.

However this method of inventory tracking can be costly for a company. If Zapp Electronics uses the lastin firstout method with a periodic system the 100 units remaining at the end of the period are assumed to be the same 100. Full PDF Package Download Full PDF Package. Is a wholesaler that uses a perpetual inventory. This method uses the inventory that was purchased first when calculating what was sold in a given period. 6 Full PDFs related. Thats a 163 compared to 2020 when inventories were depleted during the early days of COVID. Purchase Order Automation The system not only updates reorder points but also generates the purchase orders necessary for restocking with zero human interference. FIFO Perpetual is one of the stock valuation methods used for calculating closing balance of inventory in TallyPrime.

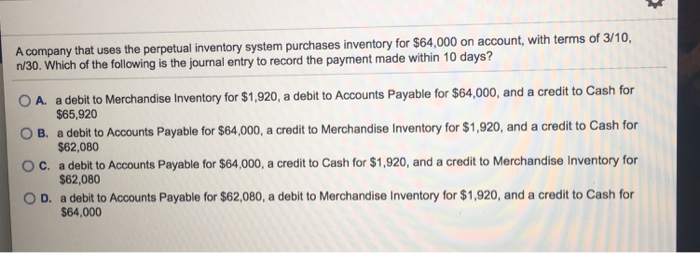

The four main inventory costing methods are as follows. Basically this method calculates inventory value. When a company uses the perpetual inventory system and makes a purchase they will automatically update the Merchandise Inventory account. Full PDF Package Download Full PDF Package. The four main inventory costing methods are as follows. Date transaction units unit cost sale price March purchase 19000 9. The weighted average cost method uses a weighted cost that averages the price of all purchased inventory.

.png)

Post a Comment for "A Company That Uses The Perpetual Inventory System Purchased Inventory For"